Want a lower auto bill without cutting coverage? If your household runs two or more cars, you can unlock multi-car vehicle insurance discounts that trim the price per car. Insurers love when you keep more than one vehicle under the same account, so they reward you with a lower rate on each one.

A multi-car discount is a price reduction for insuring 2 or more vehicles with the same auto insurer. In 2025, typical savings range from about 8% to 25% per car, depending on the company, state, and your driver profile. Brands that advertise these discounts include GEICO and Amica (up to 25%), Progressive (about 12%), State Farm (up to 12%), Travelers (around 8%), and AAA (varies by club). Some companies add more savings when you bundle auto with home or renters.

This guide breaks down how multi-car discounts work, who qualifies, how to stack savings, and how to compare quotes the smart way. You will also see simple math examples so the savings feel real

Multi-Car Vehicle Insurance Discounts: How to Qualify, Stack Savings, and Pay Less in 2025

Want a lower auto bill without cutting coverage? If your household runs two or more cars, you can unlock multi-car vehicle insurance discounts that trim the price per car. Insurers love when you keep more than one vehicle under the same account, so they reward you with a lower rate on each one.

A multi-car discount is a price reduction for insuring 2 or more vehicles with the same auto insurer. In 2025, typical savings range from about 8% to 25% per car, depending on the company, state, and your driver profile. Brands that advertise these discounts include GEICO and Amica (up to 25%), Progressive (about 12%), State Farm (up to 12%), Travelers (around 8%), and AAA (varies by club). Some companies add more savings when you bundle auto with home or renters.

This guide breaks down how multi-car discounts work, who qualifies, how to stack savings, and how to compare quotes the smart way. You will also see simple math examples so the savings feel real.

How Multi-Car Vehicle Insurance Discounts Work (And Who Qualifies)

Insure two or more cars with the same company, and each car often gets a lower rate than if you put them on separate policies. Some carriers apply the discount when the vehicles share one policy. Others can apply it across linked policies under the same account. Exact rules change by company and state.

Simple Definition and How the Savings Apply Per Car

A multi-car discount reduces the premium when 2 or more vehicles are listed under the same policy or account family. The savings usually apply to each listed vehicle, not only the second one. The cars need to be rated together at the same address in most cases. Prices still depend on driver history, age, and the vehicles themselves, which is why results vary.

For a quick explainer on how insurers structure multi-car pricing and eligibility, see this short guide on how to get a multi-car insurance discount.

Who Usually Qualifies (Household, Roommates, Teens)

Most companies look for simple, consistent info:

- Two or more cars insured with the same company

- Same physical or garaging address for the cars

- All household drivers disclosed, including teens

- Garaging address matches where each car is kept

Family members at the same address almost always qualify. Many carriers also allow roommates at the same address. Teens and college students who live at home or return on breaks count. Leased and financed cars qualify when listed and insured correctly.

Multi-Car vs. Multi-Policy vs. Bundling

These terms sound similar but work differently:

- Multi-car discount: Two or more cars with one auto insurer.

- Multi-policy or bundling: Auto plus another line, like home, renters, condo, or umbrella.

- Stacking: Some insurers apply both multi-car and bundling at once.

Ask your agent whether multi-vehicle, multi-driver, and bundle discounts can combine with other perks like paperless or pay-in-full. Guides like CNBC Select’s review of the best car insurance discounts of 2025 can help you spot stackable deals, including strong multi-vehicle savings from big brands.

When a Multi-Car Policy May Not Be Cheapest

There are exceptions:

- A high-risk driver can raise the price for the whole policy.

- Specialty or classic cars might rate better with a niche carrier.

- If cars live at different addresses, eligibility can break.

- Some states have unique rules that change the math.

Get quotes both ways, all together and split out, then compare totals. For rate context and sample pricing leaders, see MoneyGeek’s analysis of the cheapest multi-car insurance companies.

How Much You Can Save in 2025 (Real Numbers and Brands)

Discounts vary by state, risk level, and underwriting. Treat these as typical ranges, then confirm with a quote tied to your address and driving record.

Typical Savings Range in 2025

Most drivers see roughly 8% to 25% per car when they insure multiple vehicles with one company. The higher end usually requires clean records, the right state, and meeting all eligibility rules. The discount lowers the rate, but the base price still depends on your record, age, and vehicle type.

For brand-by-brand discount snapshots and other stackable deals, this overview of best car insurance discounts in 2025 is a helpful reference.

Top Companies Offering Multi-Car Deals Today

Insurers advertise different ranges, and not all states publish exact percentages. Common examples:

- GEICO and Amica: Up to 25% multi-car savings, depending on eligibility. See this quick breakdown of best discounts for multiple cars.

- Progressive: About 12% on average when you add more than one vehicle.

- State Farm: Often around 10% to 12% for multi-vehicle in many markets.

- Travelers: Frequently around 8% or more, varies by state.

- AAA: Varies by local club and your profile.

Some industry roundups also list American Family and State Farm among brands that can reach higher savings in select markets, which is why quotes matter. See a broader sweep of brand discount claims here: best multi-vehicle auto insurance discounts in 2025.

If you want an overall view of insurer quality and options beyond just the discount percent, check the rankings of the best car insurance companies.

New Ways to Boost Savings in 2025

Bundling auto with home or renters is hot right now, and many carriers say it can deliver a strong extra price break. Some brands, like American Family, aggressively promote bundle savings alongside multi-car. Most carriers also throw in smaller breaks for paperless billing, paying in full, and starting the quote online. USAA offers bundle savings for eligible military families.

A lot of these extras stack with multi-car. Review a discount guide to see what else you can add, like Insurance.com’s quick list of common savings, including bundling and good driver deals, in its auto insurance discounts guide for 2025.

What Else Changes Your Final Price

Four factors still do the heavy lifting:

- Location: State and ZIP shape your base rate.

- Driving record and claims: Tickets and at-fault accidents add cost.

- Coverage and deductibles: Higher limits and low deductibles cost more.

- The cars: Age, safety tech, and repair costs matter.

A discount will not erase a major ticket or crash. Raise deductibles only if you can cover them in cash.

Qualify, Stack Discounts, and Keep the Savings Year-Round

Follow this plan to lock in your discount, stack extra savings, and avoid surprises after life changes.

Quick Eligibility Checklist and What to Gather

Have these ready before you shop:

- Driver names and license numbers

- VINs and annual mileage for each car

- Garaging address for each vehicle

- Lienholder or lease info, if financed

- Current coverages and deductibles

- All household drivers listed

- All cars rated at the same address (unless the insurer allows an exception)

Stack With Other Discounts the Right Way

Layer your savings in a clean order:

- Start with multi-car: Add all vehicles to the same insurer.

- Bundle next: Add home, renters, condo, or umbrella when it makes sense.

- Then request extras: Paperless, auto-pay, pay-in-full, online quote, safe driver, good student, defensive driving.

Rules vary, so ask the agent to apply everything you qualify for. Keep documents handy for student grades or course completion. For a quick refresher on how different discounts combine and where the ceiling usually sits, skim this list of best car insurance discounts of 2025.

Smart Tips for Families With Teens or New Drivers

- Add teen drivers to the household policy. This protects eligibility and often prices better than a separate policy.

- Ask about good student and driver education discounts.

- Compare pricing with and without an older vehicle on liability only for a teen.

- Tell your insurer if a student lives away at school without a car, which can reduce the rating factor for that driver.

Keep Your Discount After Life Changes

Life moves, cars change, roommates come and go. Update your insurer right away when you:

- Move to a new address

- Add, trade, or sell a car

- Add a driver or someone new moves in

- Change how a car is used, like starting a new commute

If you do not update, your policy could be re-rated, you could face a surcharge, or the discount could drop.

Compare Quotes and Switch With Confidence

A strong discount does not always mean the best price. Compare offers for the best total value, including coverage, claims support, and perks.

Step-by-Step to Get Accurate Multi-Car Quotes

- List all drivers and all vehicles.

- Decide on your coverage limits and deductibles before you shop.

- Get quotes from at least three national brands and one regional carrier.

- Ask to apply the multi-car discount and all other eligible discounts.

- Compare six-month and twelve-month policy terms.

- Save each written quote and review line by line.

To see which carriers tend to price multi-car policies competitively right now, scan MoneyGeek’s data-backed look at the cheapest multi-car insurance companies.

Key Questions to Ask Before You Buy

- Does my multi-car discount stack with my bundle discount?

- What happens if I remove a car mid-term?

- Are roadside and rental car options priced per car, or per policy?

- Are there fees for paying monthly instead of in full?

- Is accident forgiveness available, and how does it apply to each driver?

Common Mistakes That Cost People Money

Avoid these budget killers:

- Listing different addresses for cars kept at the same home

- Forgetting to add a new driver who lives in the home

- Mismatching coverage levels across cars without a plan

- Skipping bundling when you already have home or renters

- Not asking for paperless, auto-pay, or pay-in-full deals

- Not re-shopping at renewal, especially after tickets fall off

For a side-by-side of which companies pitch strong multi-car savings and how they compare, this roundup of best discounts for multiple cars is useful. Pair that with a broader discount overview to plan your stack, like Insurance.com’s 2025 discounts guide.

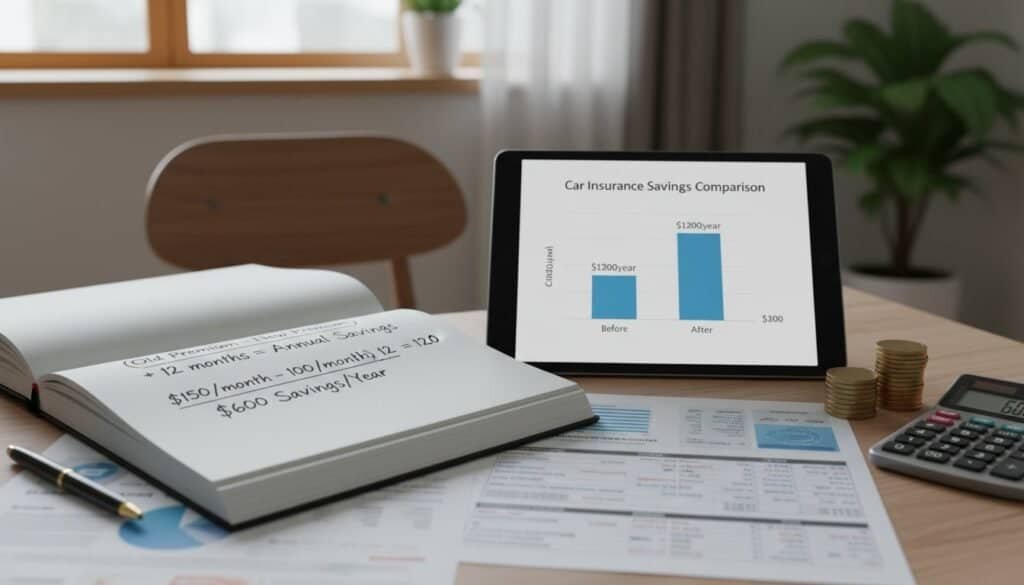

Quick Math Examples to Estimate Your Savings

Here are two simple scenarios to make the savings feel concrete.

- Example 1: Two cars at 1,400 dollars each, 12% multi-car discount

- Base premium: 1,400 + 1,400 = 2,800 dollars

- Discount: 12% of each car = 168 dollars per car

- Total discount: 336 dollars

- New total: 2,800 − 336 = 2,464 dollars

- Savings per car: 168 dollars

- Example 2: Three cars at 1,200 dollars each, 20% multi-car discount, plus a 5% bundle discount on the total

- Base premium: 1,200 × 3 = 3,600 dollars

- Multi-car discount: 20% per car = 240 dollars per car

- Total multi-car discount: 720 dollars

- Subtotal after multi-car: 3,600 − 720 = 2,880 dollars

- Bundle discount: 5% of 2,880 = 144 dollars

- Final total: 2,880 − 144 = 2,736 dollars

- Total savings: 864 dollars

If you want real-world brand context while running your own math, this quick guide to multi-car insurance discounts is a handy companion.

Conclusion

Insuring two or more vehicles with the same company can trim about 8% to 25% per car in 2025. Brands like GEICO and Amica advertise the higher end in many markets, while Progressive, State Farm, Travelers, and AAA also offer meaningful savings that vary by state. Stack multi-car with bundling, paperless, and pay-in-full to push the price even lower. Compare 3 to 5 quotes, keep all drivers and cars updated, and re-shop at renewal.

Quick checklist: gather driver and vehicle info, ask to stack discounts, get written quotes, compare totals with equal coverage, and pick the best overall value. Ready to save? Get three quotes today, ask for every discount you qualify for, and lock in the best total price for your household.